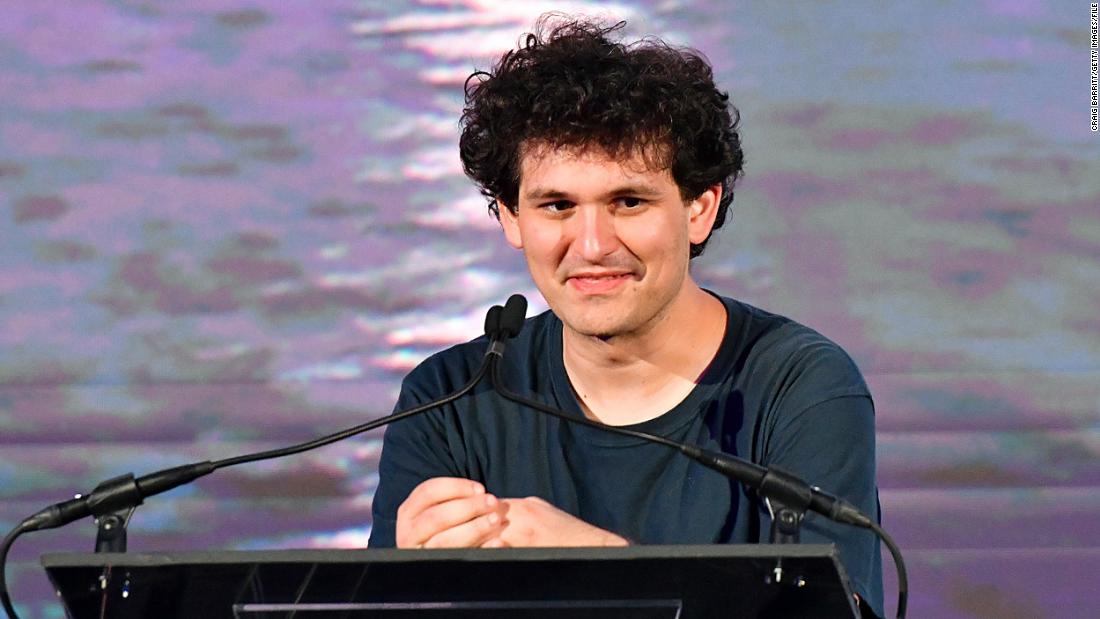

The Securities and Exchange Commission charged Sam Bankman-Fried on Tuesday with defrauding investors in his failed crypto exchange FTX.

The SEC said Bankman-Fried “orchestrated a years-long fraud” to conceal from FTX investors the diversion of customer funds to Alameda Research, his crypto trading firm.

“We allege that Sam Bankman-Fried built a house of cards on a foundation of deception while telling investors that it was one of the safest buildings in crypto,” SEC Chair Gary Gensler said in a statement.

Regulators signaled this may be just the first of multiple charges to come. The SEC said there are ongoing investigations into “other securities law violations” and into other entities and individuals. The agency added that another regulator, the Commodity Futures Trading Commission, is also charging Bankman-Fried.

Bankman-Fried’s lawyer was not immediately available for comment.

Some background: FTX achieved a $32 billion valuation by raising more than $1.8 billion since launching in May 2019, including from sophisticated investors such as BlackRock, Sequoia Capital and the Ontario Teachers’ Pension Plan. Star athletes and celebrities who backed FTX also reportedly received a stake in the company, including Tom Brady and Gisele.

The SEC alleges that Bankman-Fried, 30, duped those investors who backed FTX by promoting it as a “safe, responsible” crypto trading firm that used “sophisticated, automated” risk measures to protect customer funds.

In reality, the complaint alleges, Bankman-Fried secretly diverted FTX customer funds to effectively provide an “unlimited ‘line of credit’” to Alameda. The SEC says Bankman-Fried further concealed from investors the risk stemming from FTX’s exposure to significant holdings of overvalued, illiquid assets such as FTX-related tokens.

Bankman-Fried didn’t just use the FTX customer funds to make risky bets at his hedge fund. The SEC alleges he used that money to make undisclosed venture investments, make “lavish” real estate purchases and large political donations.

“FTX operated behind a veneer of legitimacy Mr. Bankman-Fried created by, among other things, touting its best-in-class controls, including a proprietary ‘risk engine,’ and FTX’s adherence to specific investor protection principles and detailed terms of service,” Gurbir Grewal, director of the SEC’s division of enforcement, said in a statement. “But as we allege in our complaint, that veneer wasn’t just thin, it was fraudulent.”

Bankman-Fried has previously admitting making mistakes while leading FTX, which he stepped down from last month after it filed for bankruptcy.

“Look, I screwed up,” Bankman-Fried said during a virtual appearance at the New York Times’ DealBook Summit. “There are things I would do anything to do over.”

But Bankman-Fried said he didn’t “ever try to commit fraud on anyone.”

Sumber: www.cnn.com